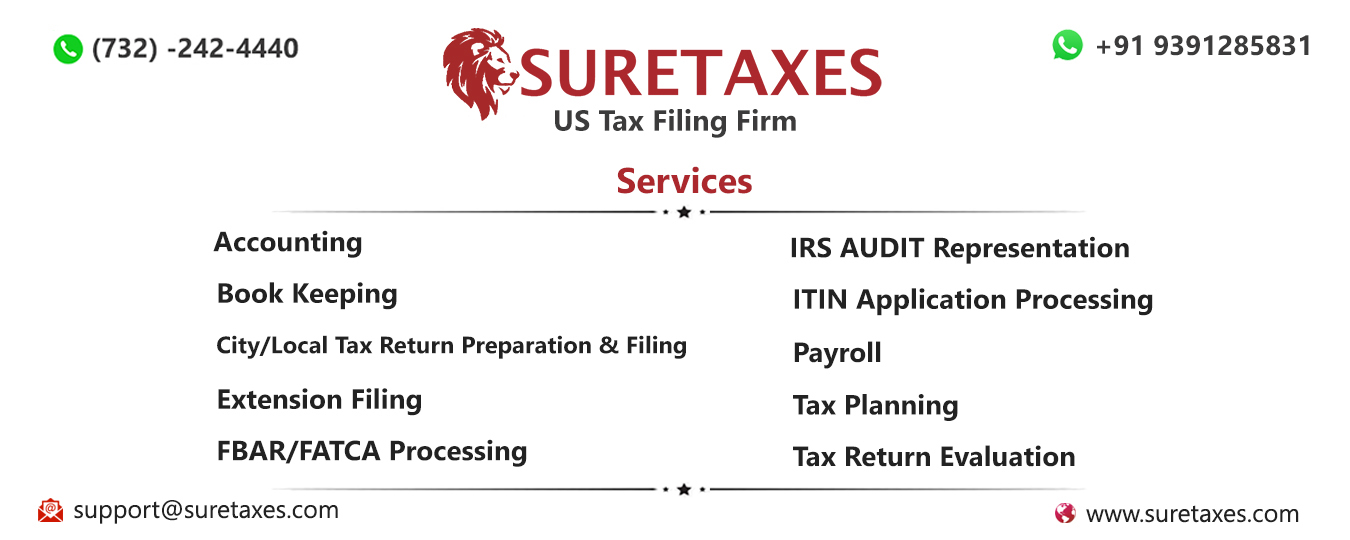

SureTaxes provide high value actions and relationships constantly helping employees with our most reliable tax services specialize in helping individuals meet their U.S. tax filing obligations, each and every client is most precious, data privacy is of our utmost importance, so we provide high value to our clients in terms based on honesty, authenticity, accountability, and trust on our service deliverance.